4 Strategies to Capture the Return of International Travel in 2023

What are you doing differently in 2023 to grow your share of international guests? If your strategy is to keep doing things the way you’ve always done them, then you’re probably not capturing as much demand from international guests as you could be.

“As we look through the next twelve months for EMEA, we see strength across the board. Something particularly interesting, and very different from what we see in North America, is that it is both resort destinations and the major European cities of London, Paris, Rome, and Lisbon that are showing really strong growth year over year in terms of on the books,” says Hannah Weller Barrise, Director of Hospitality Solutions at Duetto.

As of Q4 2022, US-based airlines like United, Delta, and American were flying nearly the same capacity on routes to and from Asia as they were in pre-pandemic 2019. Countries whose borders had been closed for extended periods of time, like Japan, have reopened. And even China has started relaxing its strict quarantine policies, no longer requiring quarantine for returning travelers as of January 2023.

So with Europe already booming and APAC in full relaunch, does this rebound of international travel mean for you and your hotel? In order to take advantage of the upcoming surge in international bookings, you’ll need to make sure your hotel is visible on the channels that international travelers use and that you offer options that suit their preferences.

Connect to Regional OTAs

Many hoteliers in the US and to an extent Europe have focused their OTA partnership efforts around just a couple of channels. But it’s important to remember that there are hundreds of OTAs out there with unique products and traveler segments, and travelers coming from different parts of the globe often use country- or region-specific OTAs.

According to a survey by the International Air Transport Association (IATA), 69% of respondents cited government border restrictions as the biggest barrier to air travel. With Asian markets opening up, a massive wave of pent up demand from those regions will continue to flood the market with bookings and your hotel should be present where those travelers are searching and booking their trips. For example, two of the largest OTAs in Asia, Agoda and CTrip, are essential components of your international strategy. But some channel managers only offer limited connectivity to these channels – or no connectivity at all. A tool like Property Connector by DerbySoft can unlock these channels by providing a robust connection that syncs not only rates and availability, but also content, so your hotel can be well represented to the large audiences who use these channels.

Diversify Your Corporate Segment

Diversify Your Corporate Segment

In addition to connecting to the GDS, your hotel can tap into new streams of corporate demand by connecting directly to international travel management companies (TMC). Rather than trying to build an international corporate segment from scratch, which is extremely difficult to do, it’s more efficient and effective to tap into the leading TMC who have already sourced this business. Your hotel should have strong direct connections to TMC in order to capitalize on this high-value segment of international business travelers.

Since they’re traveling from far away, these guests may stay longer and book higher ADR than business travelers coming from closer to home. The dynamics and characteristics of business travel changed forever during the pandemic. The reasons we used to travel for business are largely not the reasons we travel today. Accounts have shifted and behaviors have changed. By developing a strong strategy with TMC your hotel can capitalize on the next wave of business travelers.

There has been a recent shift towards blended travel, and it has changed booking patterns according to Lindsey Roeschke from market research firm Morning Consult, “In the past, people traveling for business may have sought work stations and loyalty bonuses that they could accrue on their employer’s dime, while leisure travelers might have prioritized unique décor or proximity to sights and activities. When planning a blended trip, a traveler takes all of the above into account.”

The pandemic has obviously also led to a widespread adoption of remote working practices. According to a survey by PwC, 55% of business leaders plan to make remote work a permanent option for their employees. While executives may travel to fewer trade shows and sales off-sites, they will be traveling for internal meetings more than ever to meet, collaborate and connect with colleagues within their own organizations.

Participate in Localized Distribution Strategies

Besides connecting to regional OTAs, your hotel must participate in localized campaigns to get the visibility necessary to generate bookings. Hotels need to embrace these channels and adapt to local campaign activities. For instance, in China, WeChat is a popular app used not only for communication, but also for paying bills, shopping online, and booking hotel stays. If you want your hotel to be visible on WeChat, you’ll need to select hotel marketing software that gives your team the infrastructure to launch a WeChat program, push rates and inventory, and even convert payments from China’s currency, RMB, to USD.

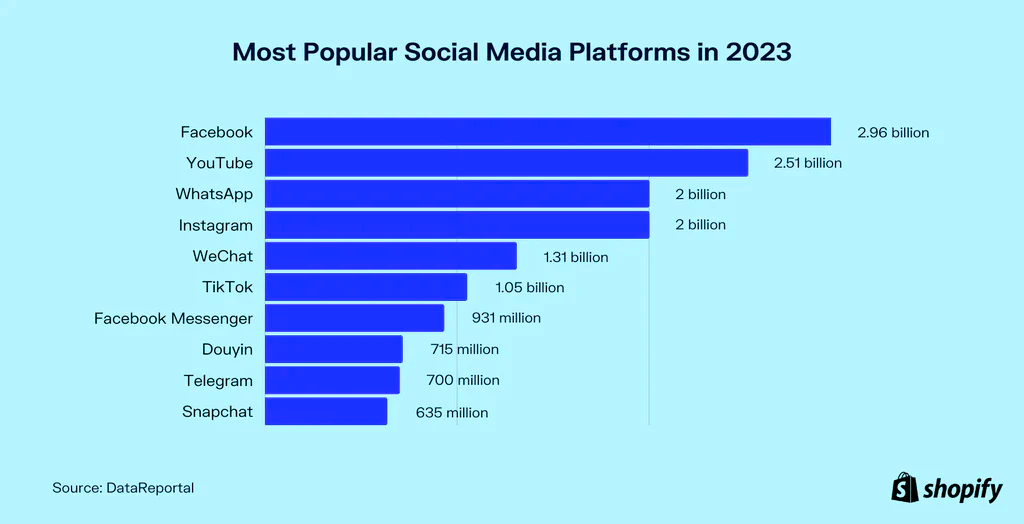

WeChat isn’t the only social channel driving hotel bookings. More recently, players like TikTok and AliPay have entered the hotel booking space with dedicated in app booking engines. Imagine you see an influencer on a TikTok at the St. Regis Bali and can book their exact hotel room from right within the TikTok app?

TikTok, YouTube and Pinterest in specific are areas where hotel marketers should be sharpening their tools and skillset. Google, by definition as a search engine, similar to Booking and Expedia, are designed to help travelers find suitable accommodations when they know where they want to go. TikTok on the other hand, and to an extent YouTube and Pinterest, inspire entirely new trips or destinations. 67% of users say TikTok inspired them to shop even when they weren’t looking to do so.⁵ That means guests who weren’t even considering to travel to your destination may now be prospective clients for really the first time ever and this is a massive opportunity. This effect has also been enabled by the age of remote work, where not only is travel inspired in new ways with these innovative channels, but now travelers have the ability to book those trips and work from anywhere more than ever before in history.

Booking capabilities are becoming increasingly popular and would be a natural extension for players like Meta (Facebook/Instagram), Snapchat and others after their retail eCommerce divisions begin to see slowing growth. Hotels should constantly stay on top of popular social media platforms in their core markets and the best ways to leverage those platforms to drive net new incremental bookings.

Expand Your Direct Channels with Paid Acquisition

Third-party channels aren’t the only option if you want to capture more international demand. Strengthening your direct channel is another great way to increase your international share. Metasearch management software offers several solutions that support your direct channel, like connections with more than 30 metasearch channels, including Google, Trivago, Tripadvisor, and Kayak. In addition to those big channels, metasearch software like DerbySoft can also make your hotel visible and competitive on smaller, regional metasearch channels like Singapore-based Wego and Hotelscan, which is popular in Europe.

As international travel bounces back, make sure your hotel can capture your fair share of this exciting spike in demand. With metasearch management software, you’ll have the right tools at your fingertips to connect your hotel to the most popular distribution channels around the world, as well as the up-and-coming disruptors, and to fuel your revenue growth.

In addition to metasearch software, hotels should be familiar with PPC (pay per click) and OTA ads in general. Hotels can use pay-per-click (PPC) ads on Google to increase direct bookings by creating targeted ads with relevant keywords and compelling ad copy, using relevant landing pages with clear calls-to-action, utilizing ad extensions to provide additional information, setting a budget and bidding strategically, and regularly analyzing and optimizing campaigns based on performance.

Additionally, OTAs like Booking.com offer display ads to hotel partners that are targeted to users based on their search history, location, and device. Hotel partners can create and manage ads through the Booking.com extranet, choose images and descriptions, and track ad performance, including impressions, clicks, and bookings generated. Display ads on Booking.com are an effective way for hotel partners to increase their visibility and drive more bookings on the platform beyond the traditional OTA commission model and metasearch offerings.

Running campaigns across multiple channels can get complex very quickly as hotel marketers need to ensure proper connectivity, rate management and budget deployment. You don’t want to spend all your budget on travelers booking a weekend that your hotel is already full and likewise you want to double down on the channels that are performing better. Working with a marketing services partner like DerbySoft is critical as their technology systems and experts are well attuned to cross-platform campaigns.

It’s absolutely vital for hotels to develop new international marketing strategies and tactics that address changes in consumer behavior and evolving travel trends. With increased competition from vacation rentals and alternative accommodations combined with a new set of expectations from travelers, hotels must adapt to attract an often entirely new kind of traveler. By developing effective marketing strategies, hotels can rebuild their businesses and drive revenue. Innovation and adaptation are key to success, hotels that continue to evolve their strategies and tactics will thrive in this next wave of the international travel rebound while those that remain complacent are likely to find themselves with unfavorable business outcomes.