DS Metasearch Insights – September Edition Read More »

The post DS Metasearch Insights – September Edition appeared first on DerbySoft.

]]>Global Meta Insights – September 2022 Edition

We continue to monitor travel and metasearch demand trends, total hotel searches, bookings and conversion rates across all metasearch channels globally to bring you valuable insights to assist hotels in identifying future opportunities for your business.

Although month over month Global Travel demand fell slightly, there is good news to share, especially in Asia Pacific. Australia, New Zealand, Singapore, Japan – these major markets are now open to travellers post a highly disciplined Covid restrictions were lifted. Japan is already seeing large volumes of inbound travellers – search volumes from Singapore has risen 300% rocketing Tokyo and Osaka in to top 10 searched and booked cities across the region.

In Europe, searches and conversion into London continues to be strong. USA search volumes and conversion into London particularly saw significant growth.

Travel Demand in general continues to be strong across Europe and APAC despite the rising cost of living. Month over month comparison shows a 20% growth in travel searches. Americas on the other-hand is showing signs of a slowdown month over month.

We will continue to monitor data and bring the latest insights throughout our monthly Meta Insight

Source: Google Destination Insights

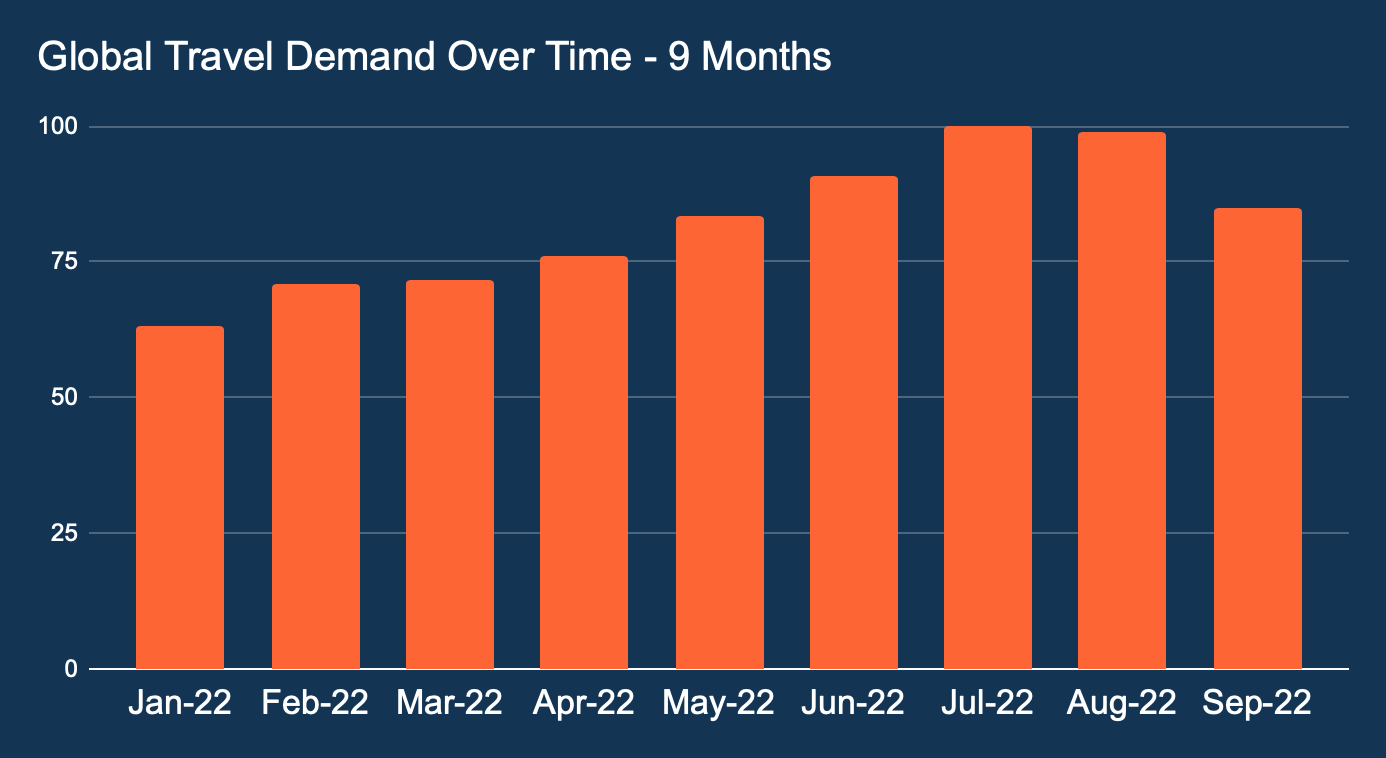

This graph shows global travel demand trends year-to-date compared to the last 7 months.

*All data is indexed. This tool uses search volume as a proxy for travel demand.

September 2022 saw travel demand somewhat slow down after a significant peak post summer. This is not unusual as typically summer months see strong travel demand right across the world.

Meta Insights by Region

Americas

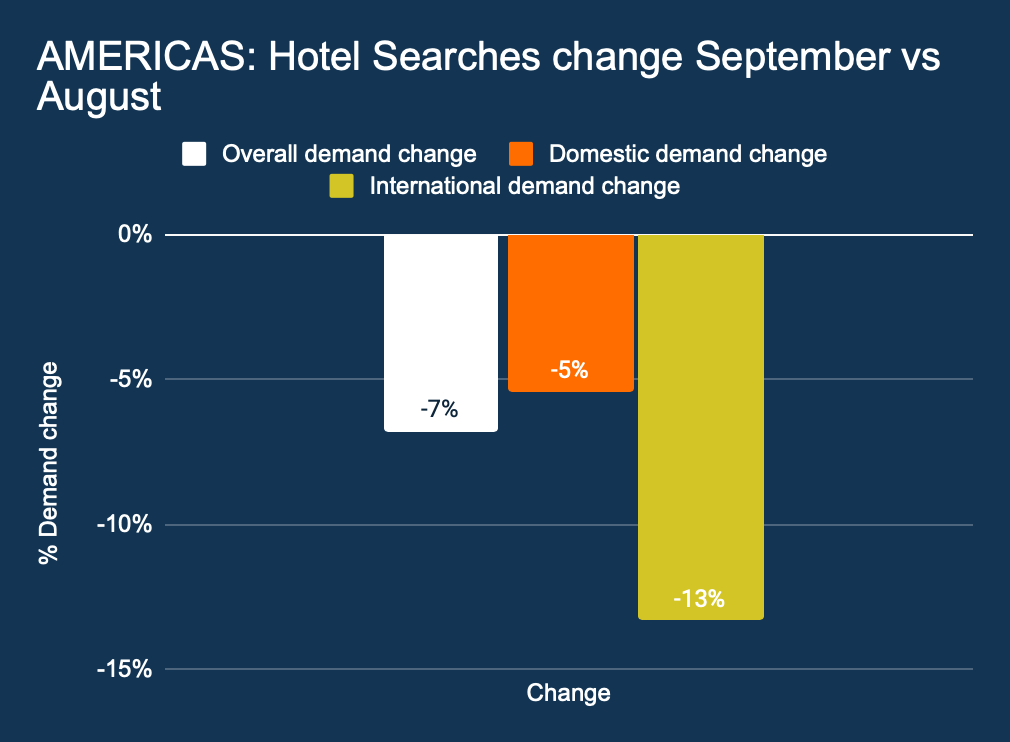

This graph shows the growth in overall hotel searches month on month, as well as the change in domestic and international hotel searches. This graph shows all hotel searches by origin

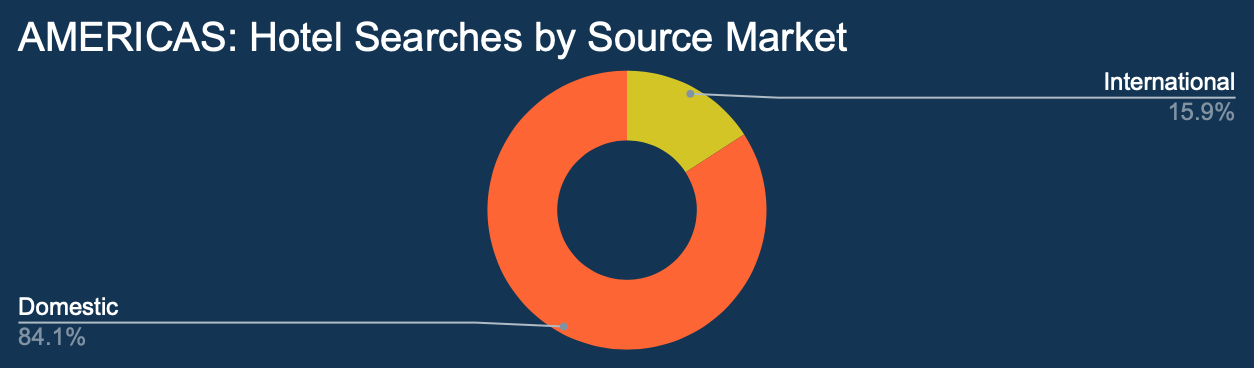

Overall Americas travel saw a slowdown September over August 2022. Data shows increased domestic travel to 84.1% mix resulting in the International travel mix slightly decreasing.

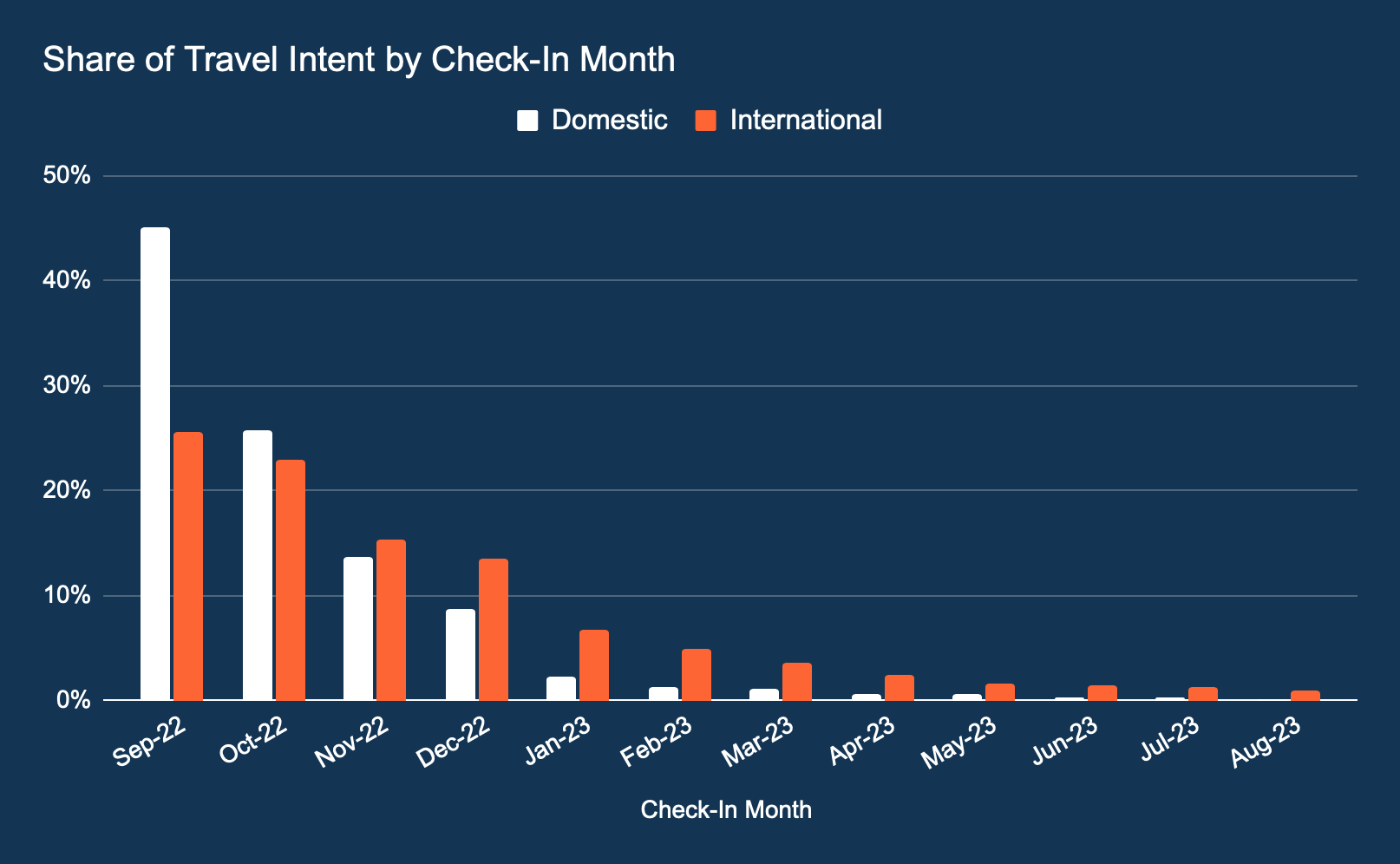

This graph shows the share of travel intent by check in month.

Travel intent with a check in date within 30 days continues to dominate the travel intent trends. International travel intent shows longer lead times, especially for checking dates in the month of December- most likely driven by Christmas and year-end holidays.

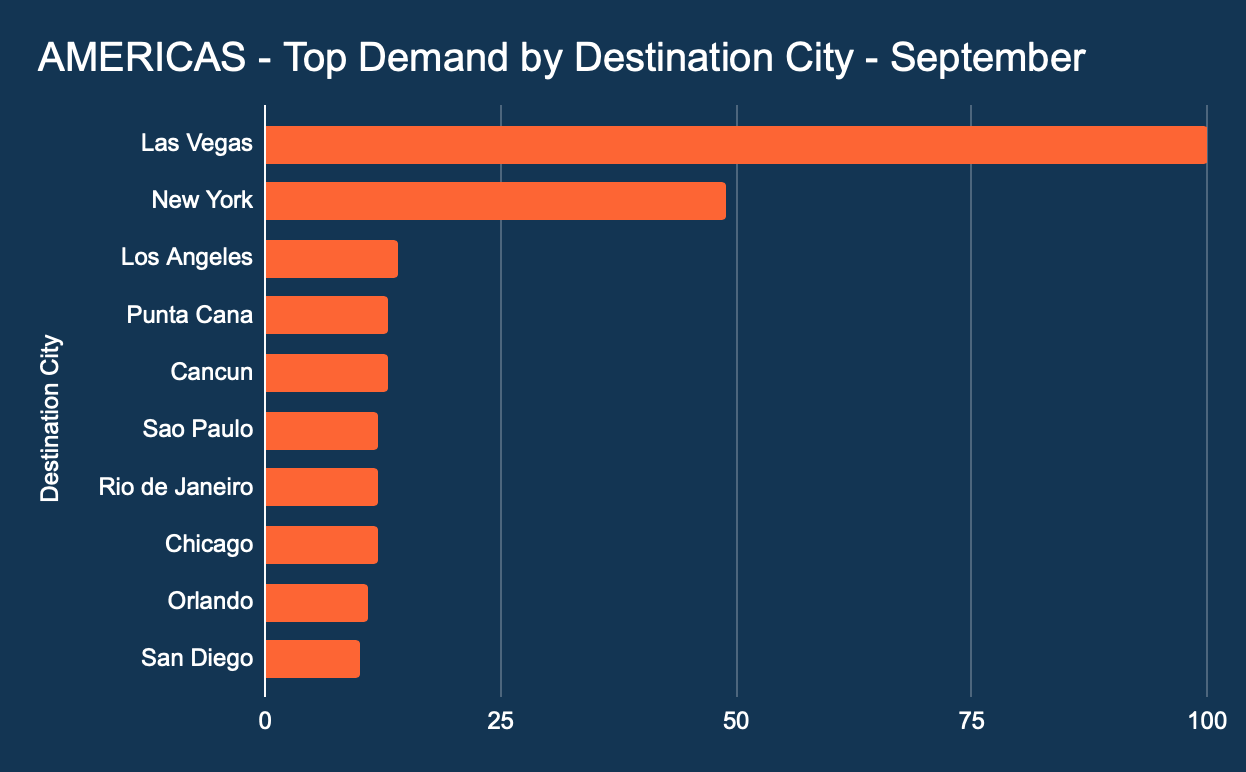

This graph shows demand by destination or city.

Whilst Las Vegas continues to dominate the top 10 searched cities, New York saw significant growth month over month. Miami dropped off the top 10 list and potentially linked to the end of summer travels.

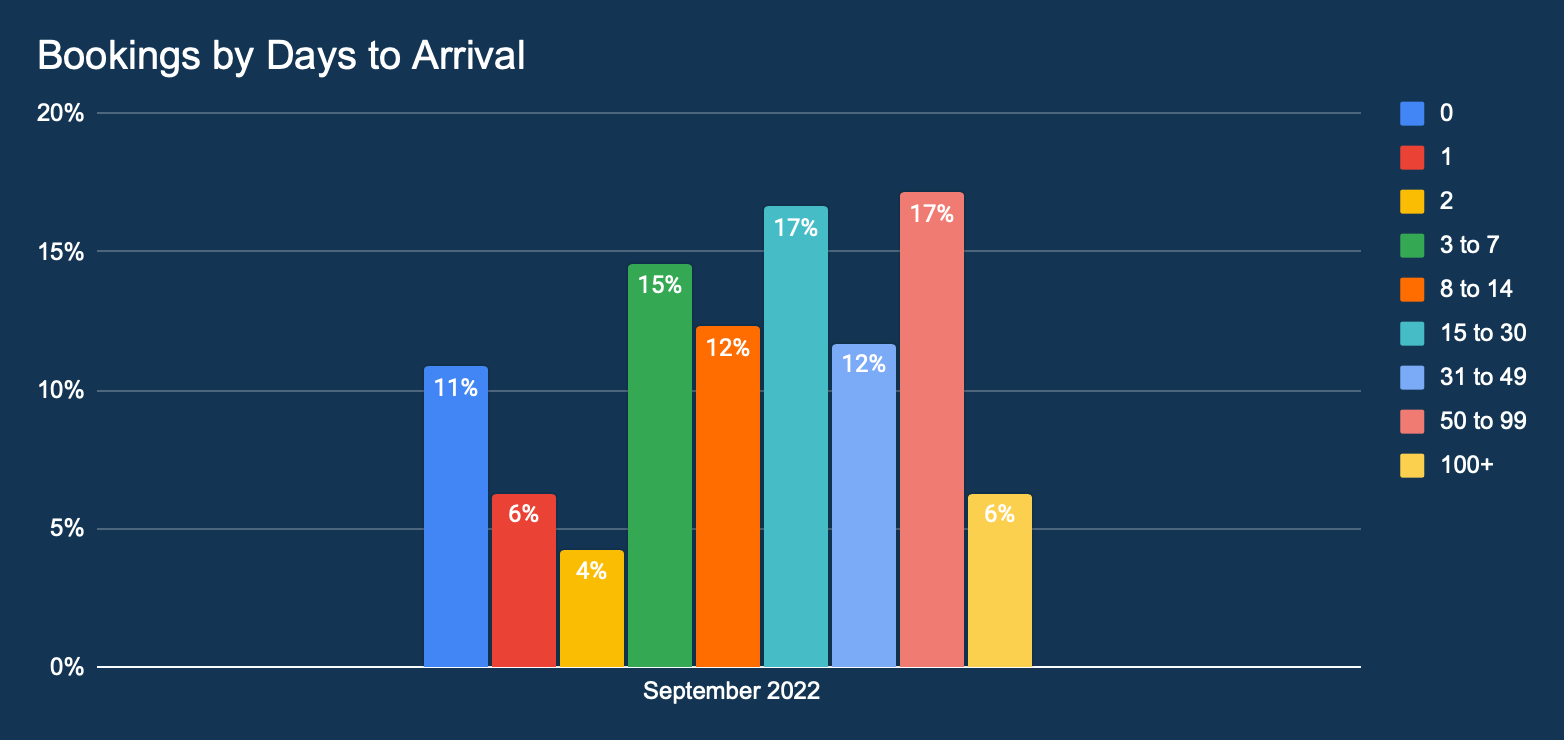

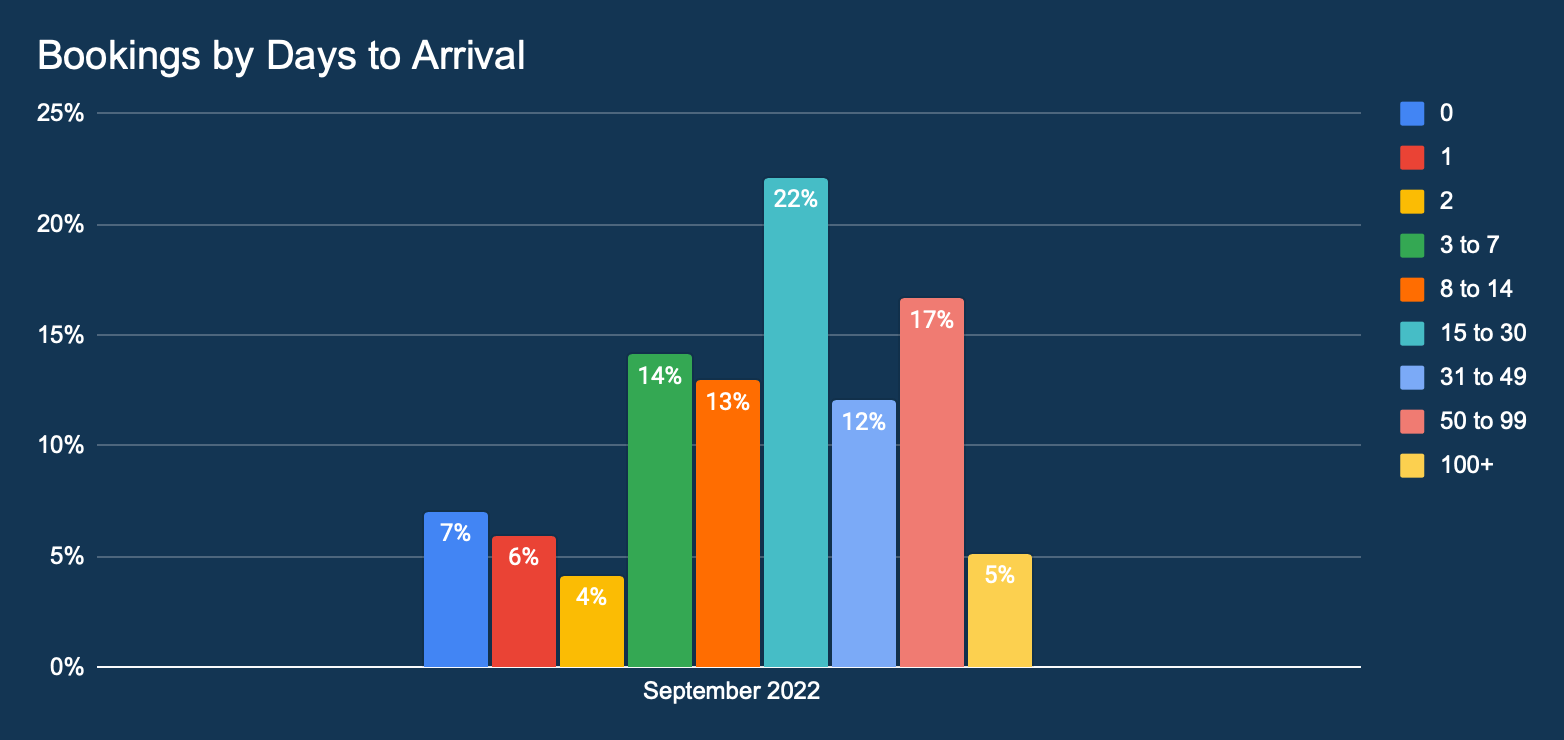

This graph shows the lead time distribution of all hotel bookings made in September 2022. The percentage indicates the proportion of bookings in comparison to the total number of hotel bookings.

60+ % of bookings were made to arrive within 30 days of the booking. Whilst short lead time bookings continued dominate, hotels cannot ignore 40+% of travel booked for 30+ days ahead. Equal spending for shorter and longer lead times should now be in the hotel’s strategic direction.

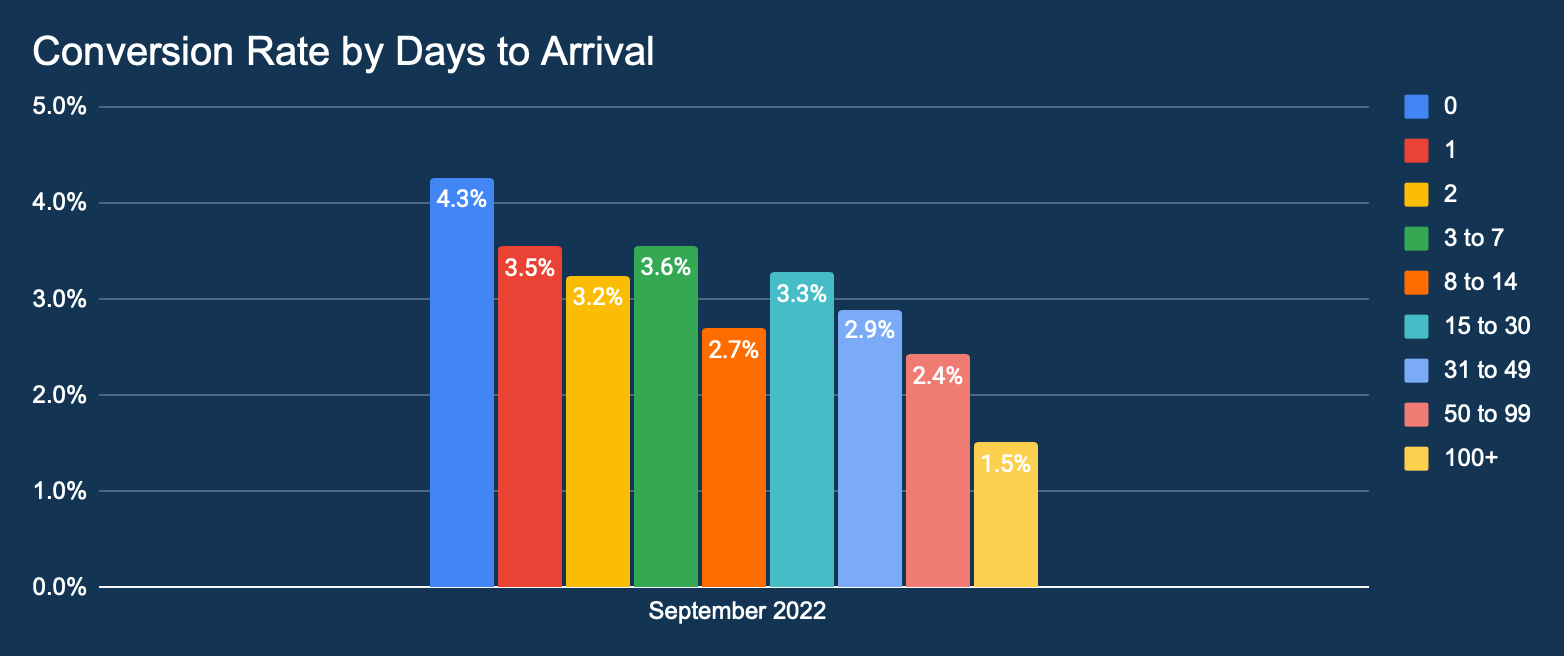

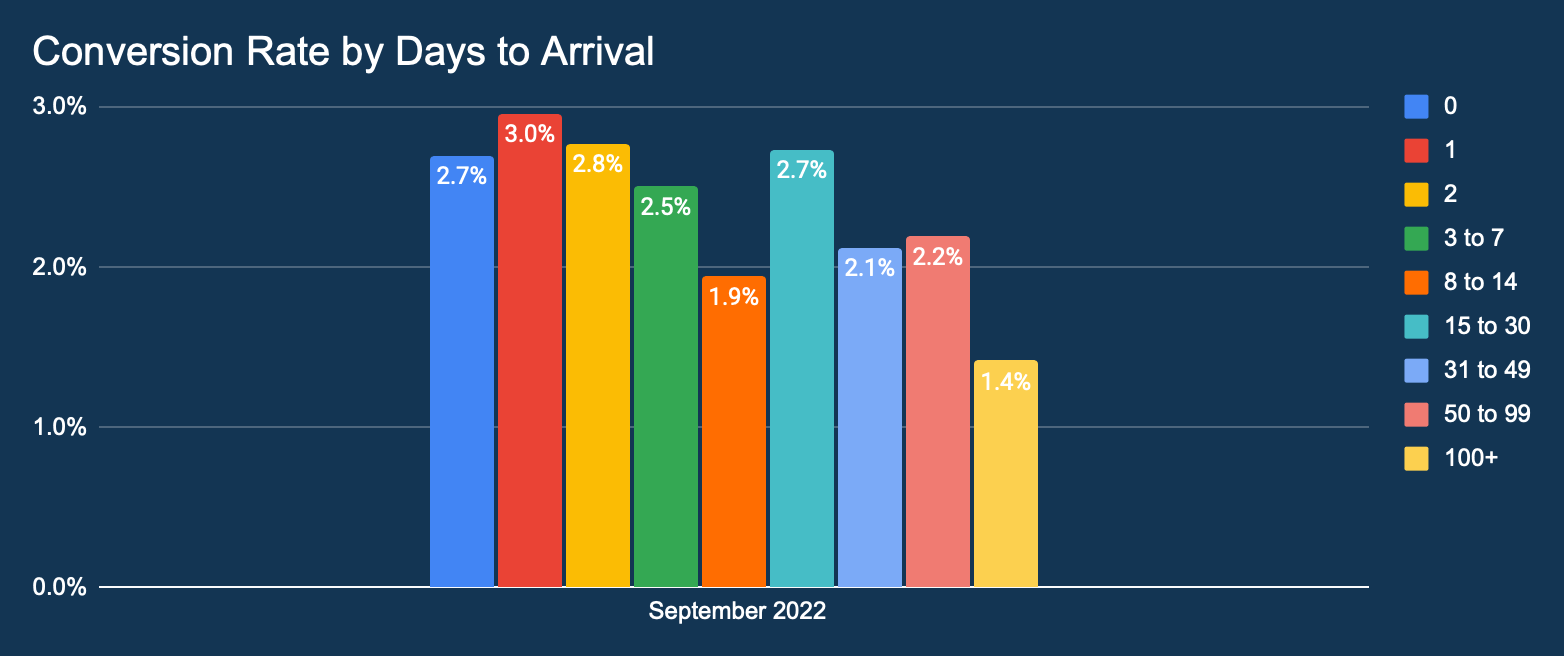

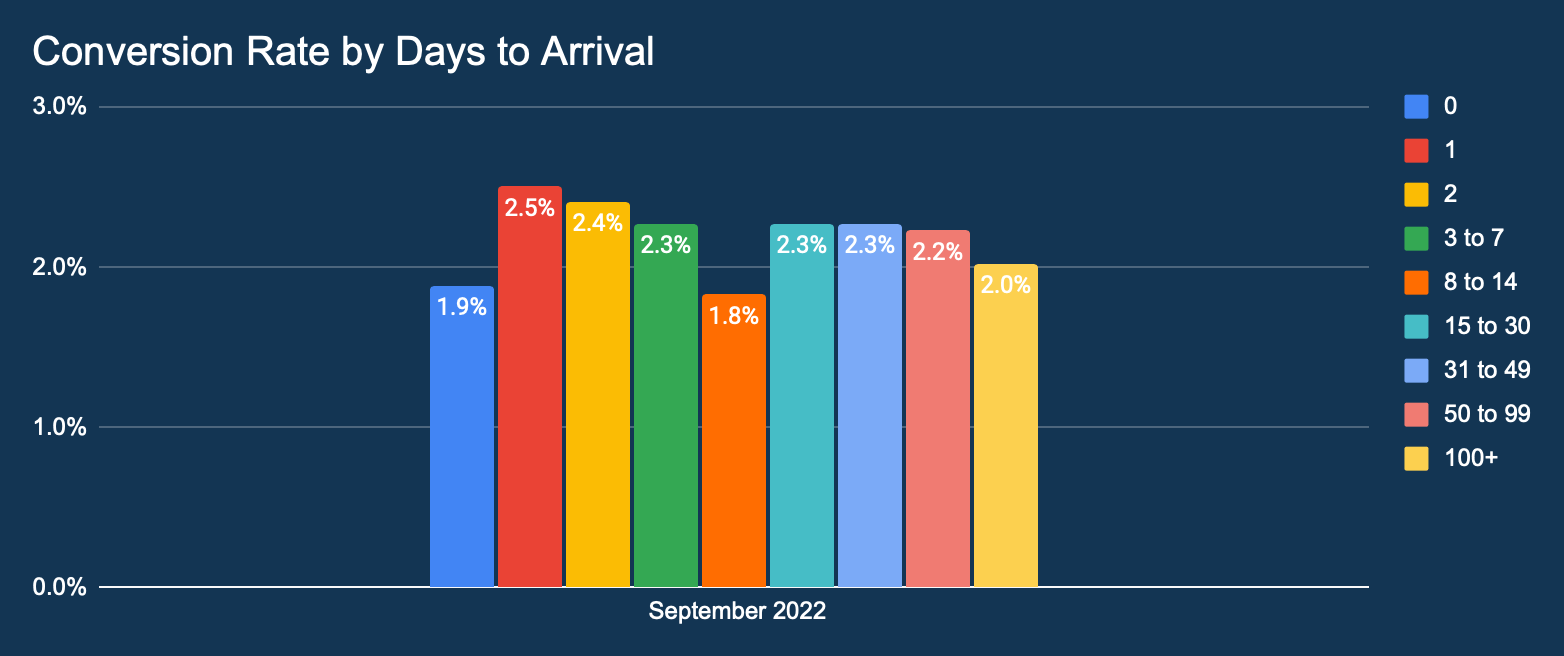

This graph shows the percentage distribution of conversion rates by lead time.

Booking conversion rate between 1 and 30 days is showing minor decreases but negligible to report and to be to be expected coming out of extremely high-intent travel summer months.

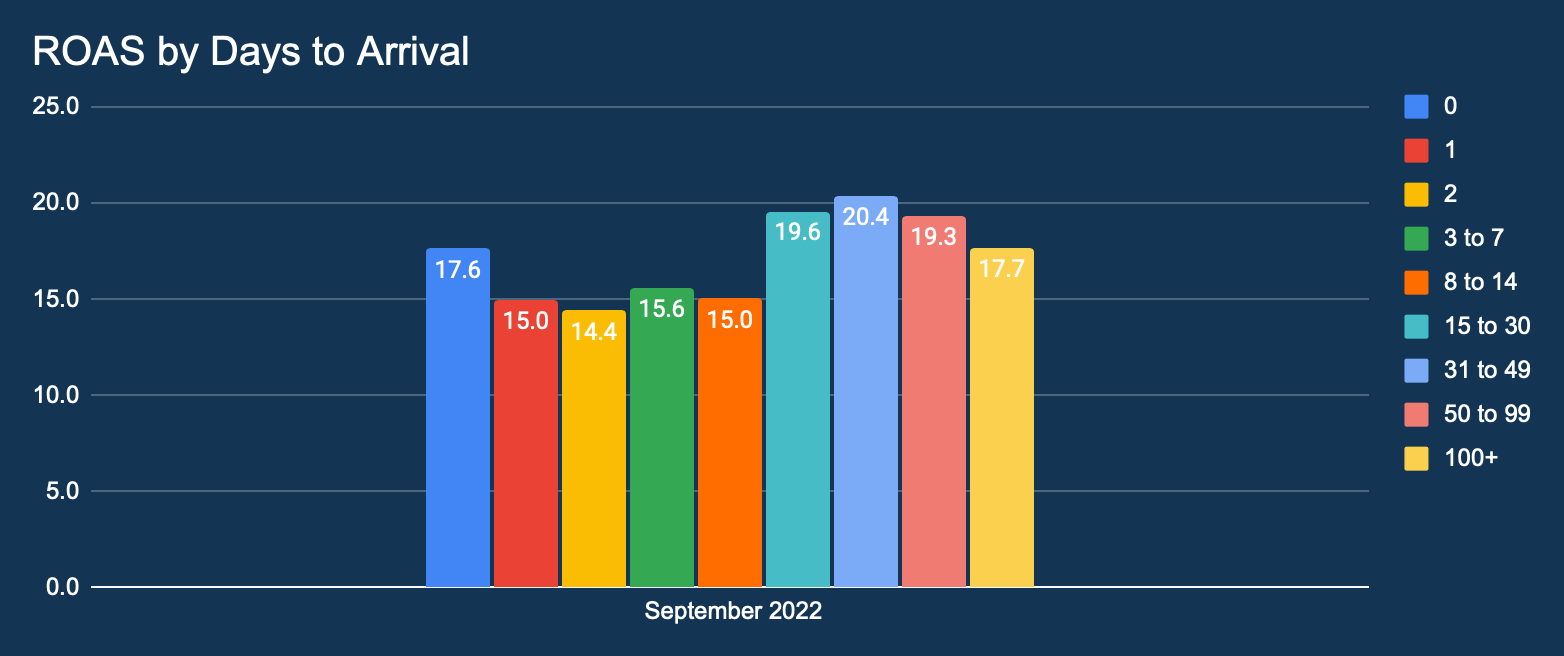

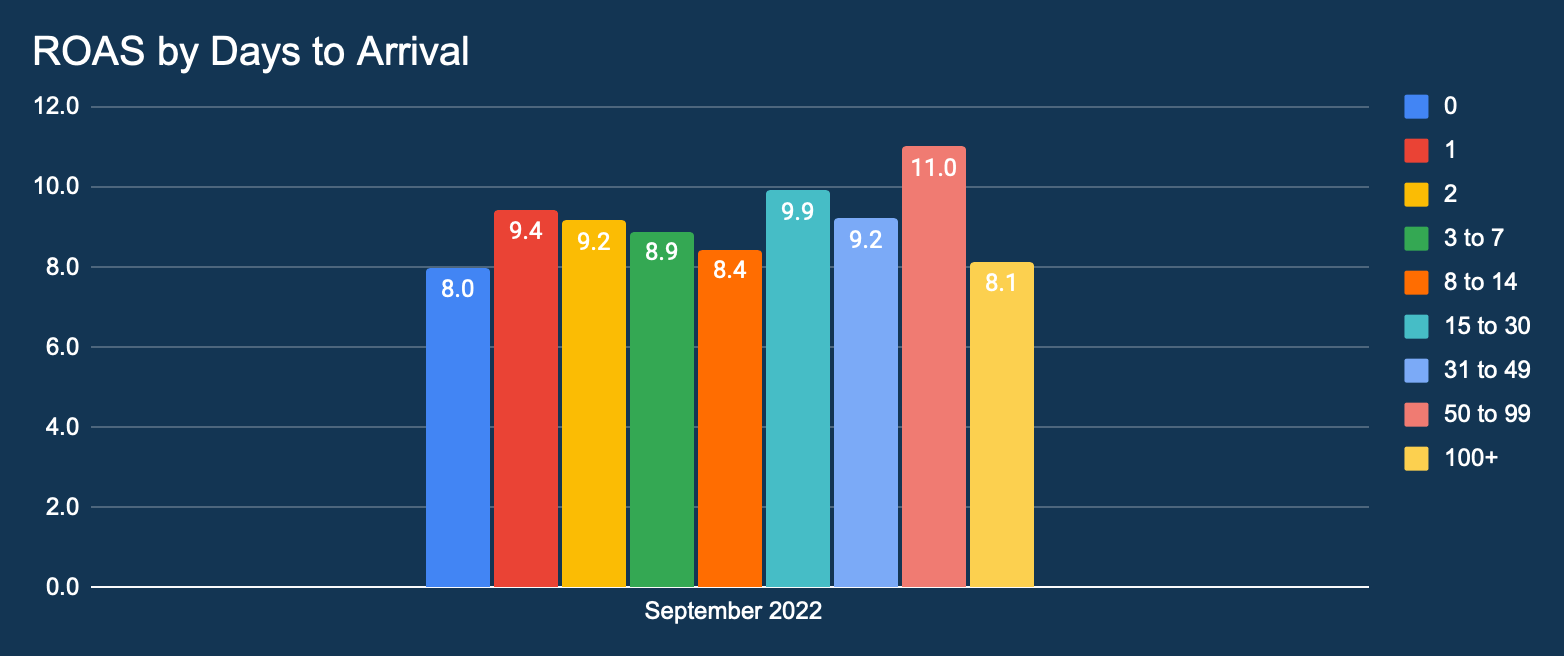

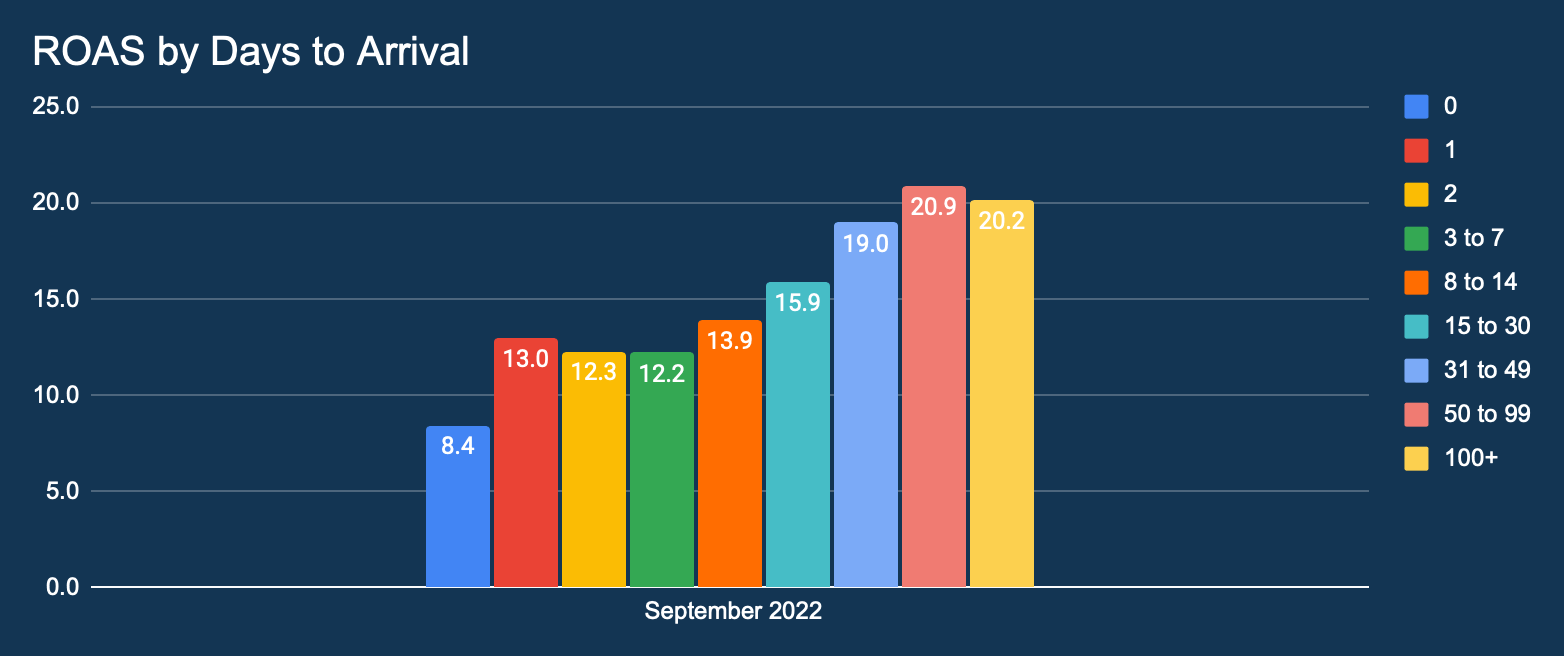

This graph shows the distribution of Return On Ad Spend (ROAS) in September 2022 by lead time.

Attention has to be drawn to conversation rates for lead time bookings. Once again highlighting hotels that further you bank bookings, Return On Advertising Spend is favourable.

EMEA

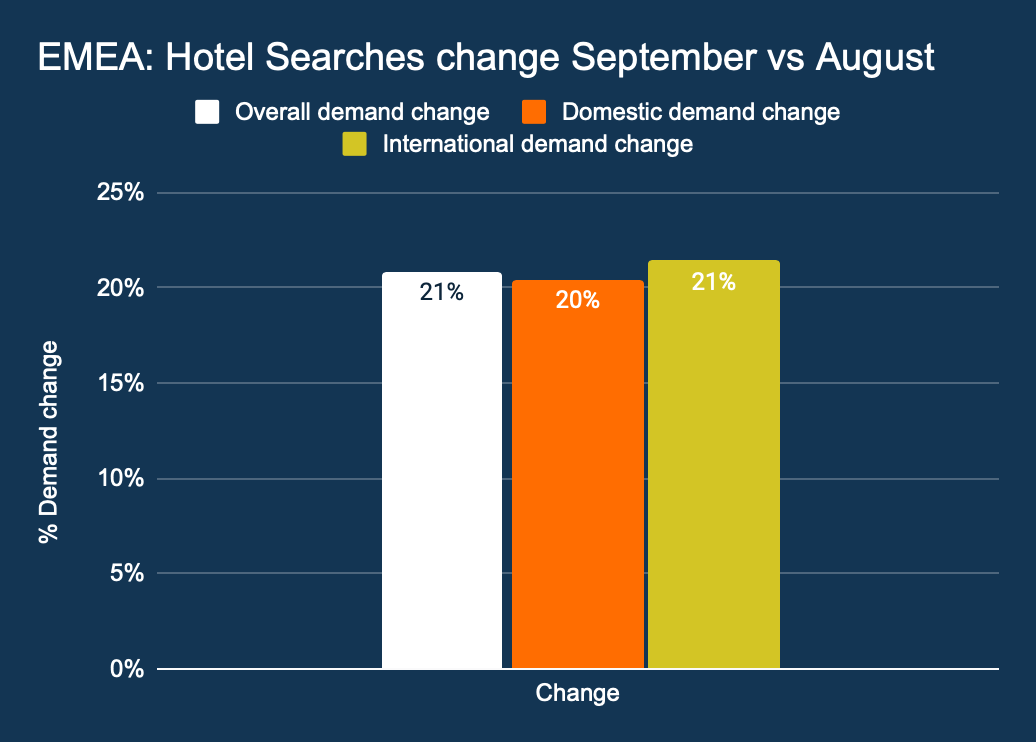

This graph shows the growth in overall hotel searches month on month, as well as the change in domestic and international hotel searches.

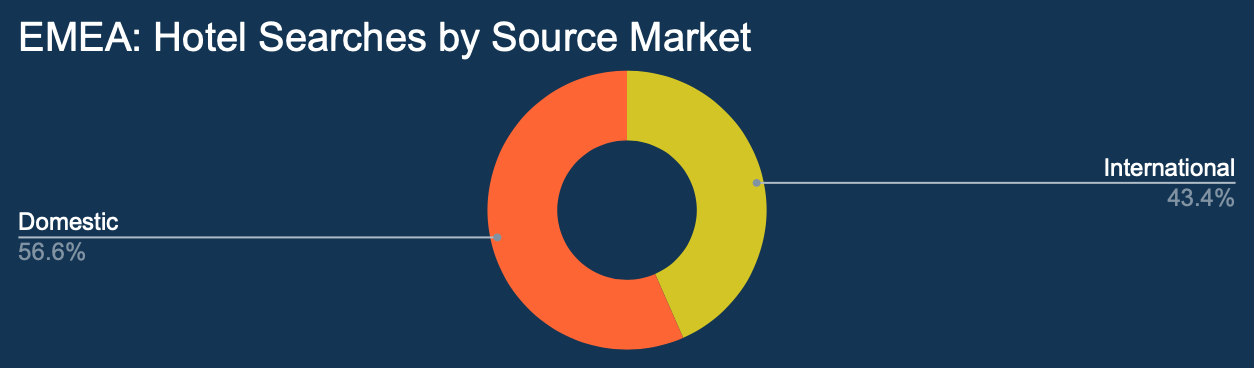

This graph shows all hotel searches by origin.

Despite inflation, rising energy costs and other factors, overall hotel searches across Europe, the Middle East and Africa has actually increased month over by 20%+. The split in domestic vs International travel remains unchanged.

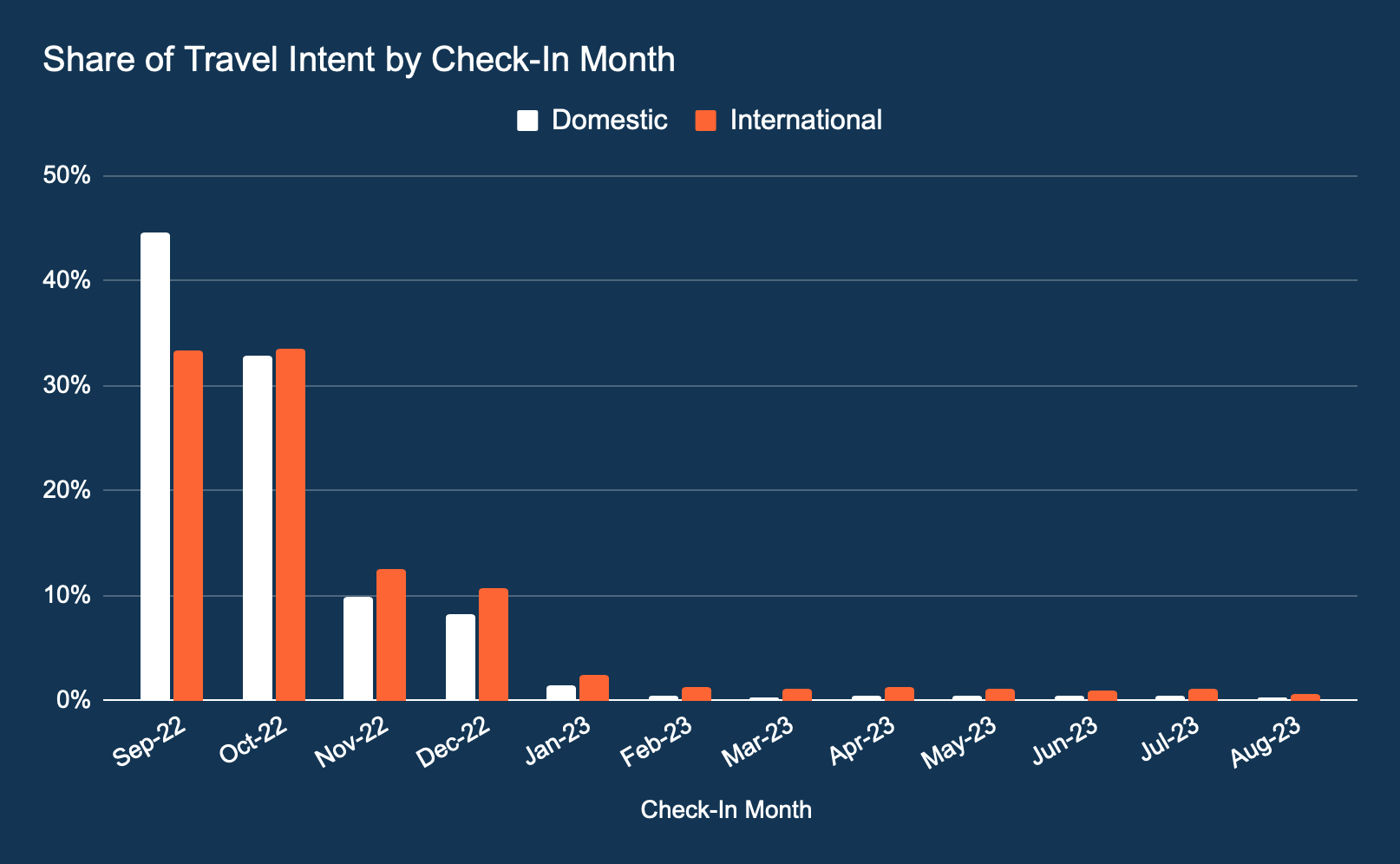

This graph shows the share of travel intent by check in month.

Like in the Americas, the share of international travel intent by check-in month peaks for 0-30 days away. International travel trends continue to the future and more so in November and December outpacing intra-reginal travel which indicates European consumers are looking to travel further afield.

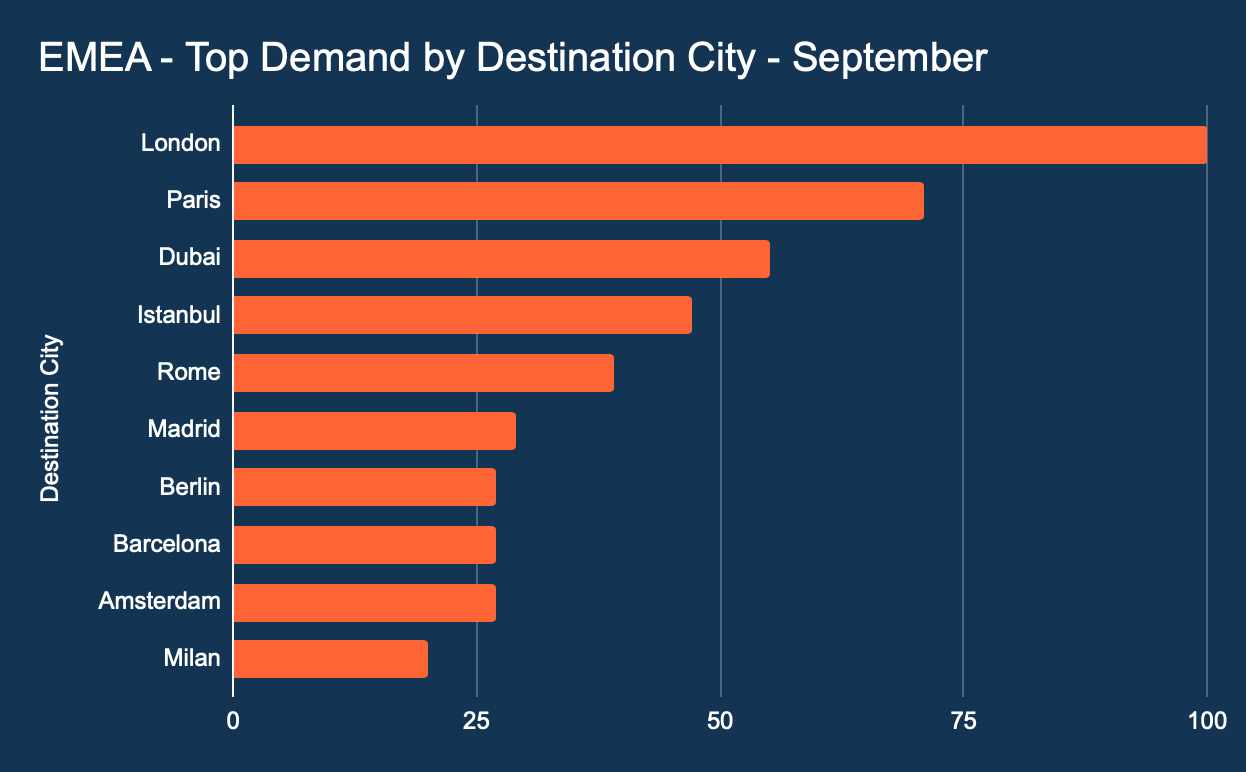

This graph shows demand by destination or city.

Cities in the top 10 list certainly supports the usual trend of Autumn travels – city and short breaks.

This graph shows the lead time distribution of all hotel bookings made in December 2021.

Bookings were most common from 3-30 days into the future. 90 day booking window remains most common. Extended forward planning in and around EMEA remains minimal, just as in America.

This graph shows the percentage distribution of conversion rates by lead time.

Conversion rates continue to be stable. Similar to Bookings by Days to arrival, hotels focus on the 90day window is evident.

This graph shows the distribution of Return On Ad Spend (ROAS) in September 2022 by lead time.

Quite a stable and encouraging picture with higher returns spread right across to short, mid and long term which is encouraging for hotels to invest and capture bookings now and to the future.

APAC

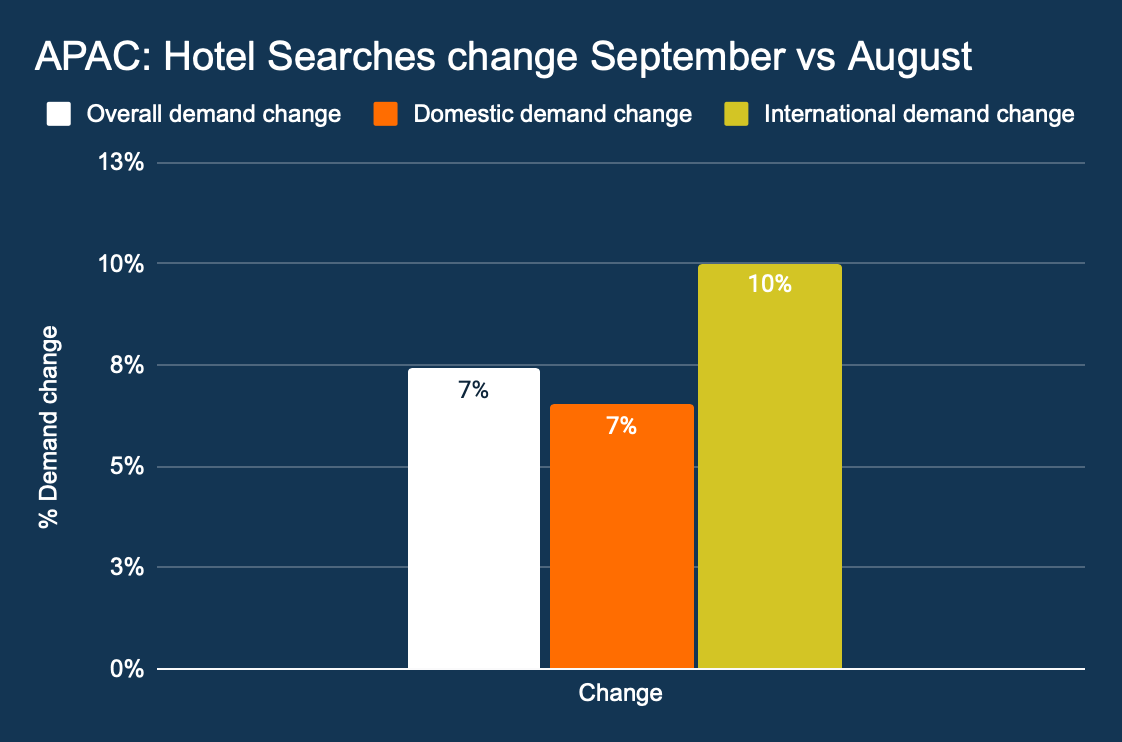

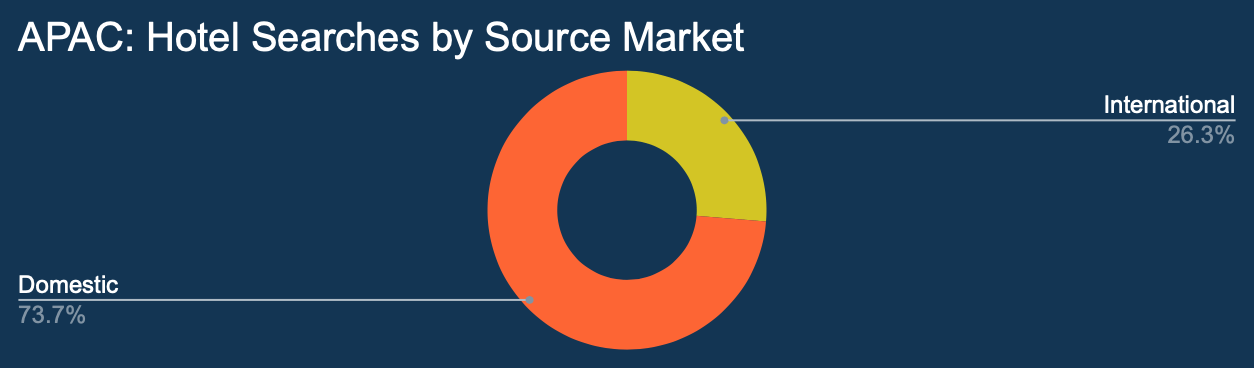

This graph shows the growth in overall hotel searches month on month, as well as the change in domestic and international hotel searches.

This graph shows all hotel searches by origin.

The month sees the region join the rest of the world in enjoying growing levels of travel interest, especially the appetite for International Travel is clearly evident. Cities in Japan has clearly enjoyed a lot of the international travel uplift (refer to top 10 cities list)

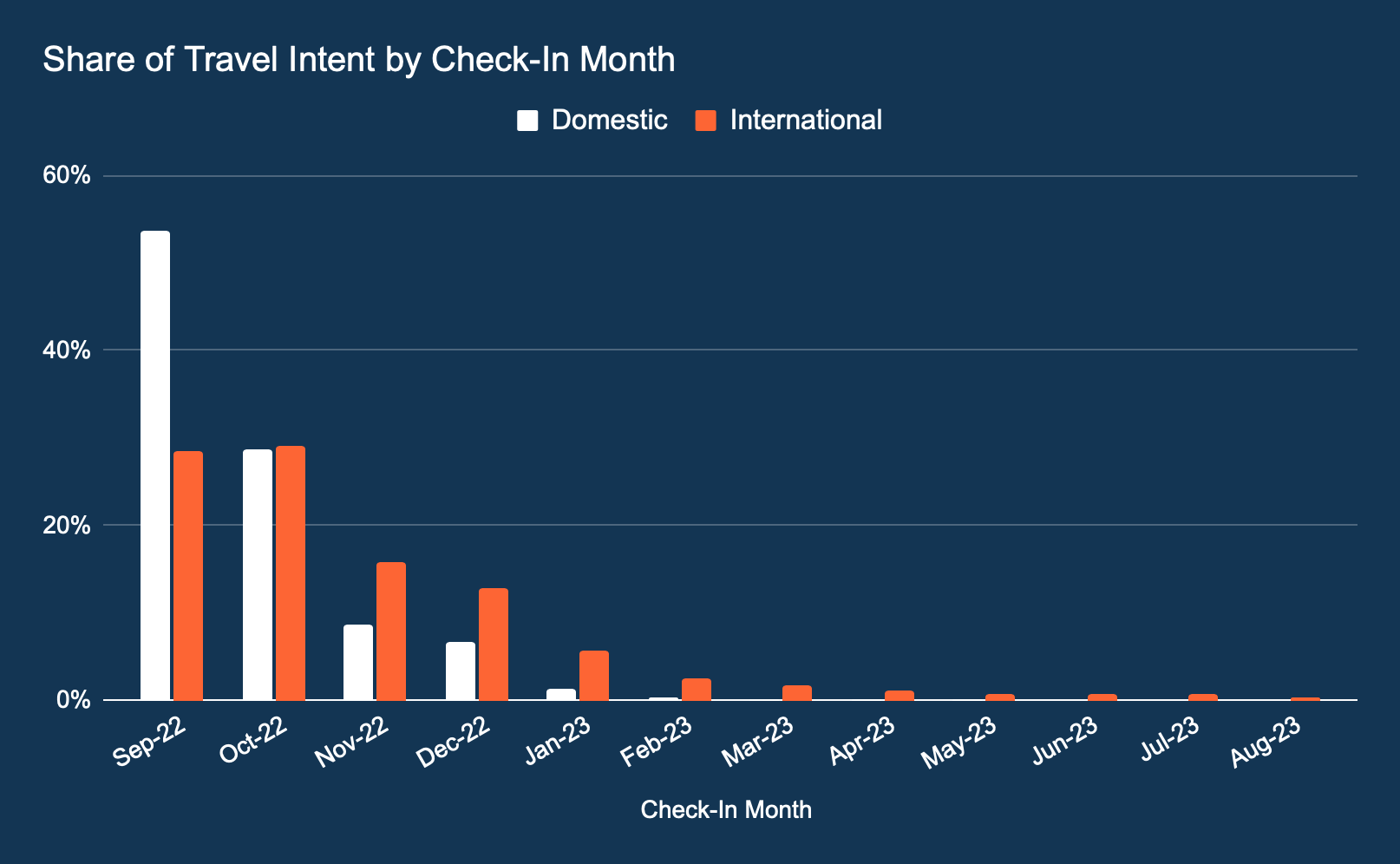

This graph shows the distribution of searched travel dates. The percentage indicates the proportioned part of every searched check-in month in comparison to the total hotel searches.

In trends similar to those seen in the Americans and EMEA, travel intent is keenest on check-ins between 0-60 days in advance. Increasing demand for International travel is evident.

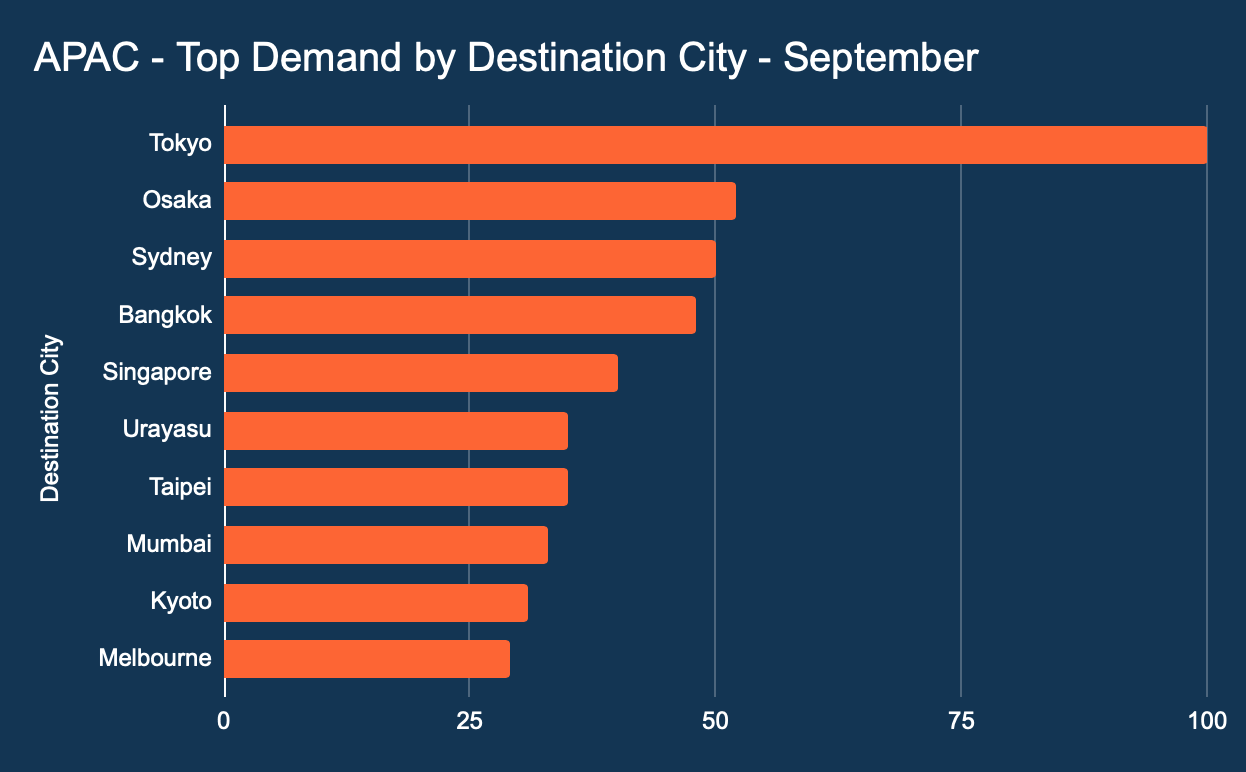

This graph shows demand by destination or city.

Three cities across Japan has seen significant boost in travel into these cities. Whilst Sydney has remained a strong feature on the list, Singapore is closely rising to the top of the list. There are signs from China that Covid restrictions may be softened and if that becomes the reality, the top 10 list will see considerable change in the coming months.

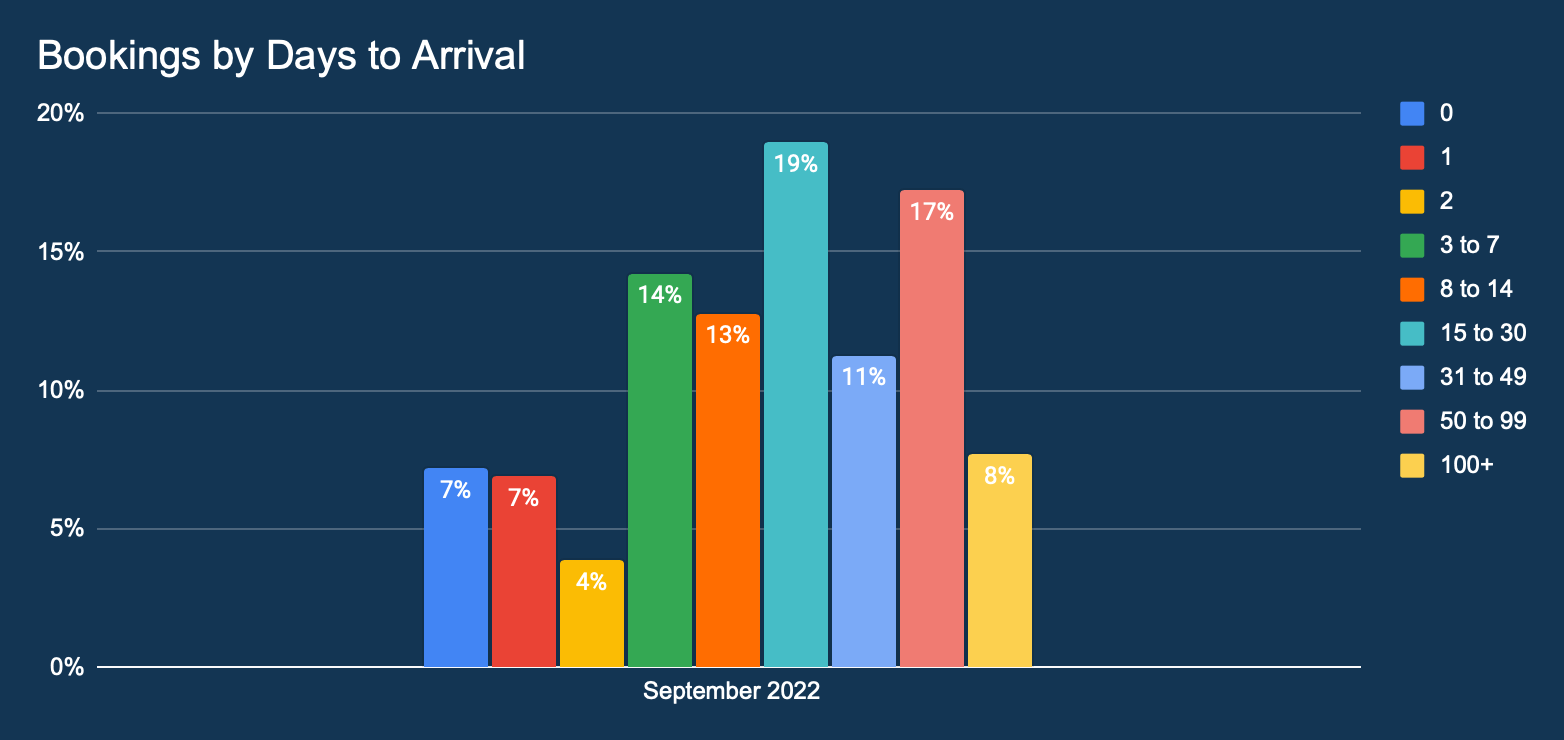

This graph shows the lead time distribution of all hotel bookings made in September 2022. The percentage indicates the proportion of bookings in comparison to the total number of hotel bookings.

Data on Bookings by Days to Arrival for APAC has shifted. Bookings with 3-30 days to arrival remain the most common bookings: over 50%. This suggests that, although spontaneous and short-term travel plans are common within the APAC region, planning is gradually improving. We may well see this trend continue to develop into winter months.

This graph shows the percentage distribution of conversion rates by lead time.

Conversion rates in the APAC region tend perform at the rate of above 2% consistently.

This graph shows the distribution of Return On Ad Spend (ROAS) in December 2021 by lead time.

Unlike other markets, Return On Advertising Spend is greater longer lead time bookings. This extremely encouraging that Asia Pacific travel confidence is up and travellers are planning further ahead.

About Marketing Services by DerbySoft

We’ve been helping the hotel sector for many years to use data and digital to build successful businesses. Competition has never been fiercer, margins never finer and driving bookings never more complex.

Simple marketing activity is not enough. To get the most from your budget; strategies, campaigns and decisions need to be smarter and more accurate.

To achieve this we have built intelligent technologies that will optimise your budget, audience, channels and results; producing multi-channel campaigns that just work, in your hands or in ours. DerbySoft offers digital marketing hotel expertise, enhanced by intelligent technology.

Have any questions?

If you would like to see more information or need any specific insights for your hotel country or source market, contact us.

The post DS Metasearch Insights – September Edition appeared first on DerbySoft.

]]>